SSD and RAM chip manufacturers seem to have scaled back production and will focus on raising prices as demand drops. It’s a long-running story that has good news and bad news for consumers like this.

What happens to memory sticks?

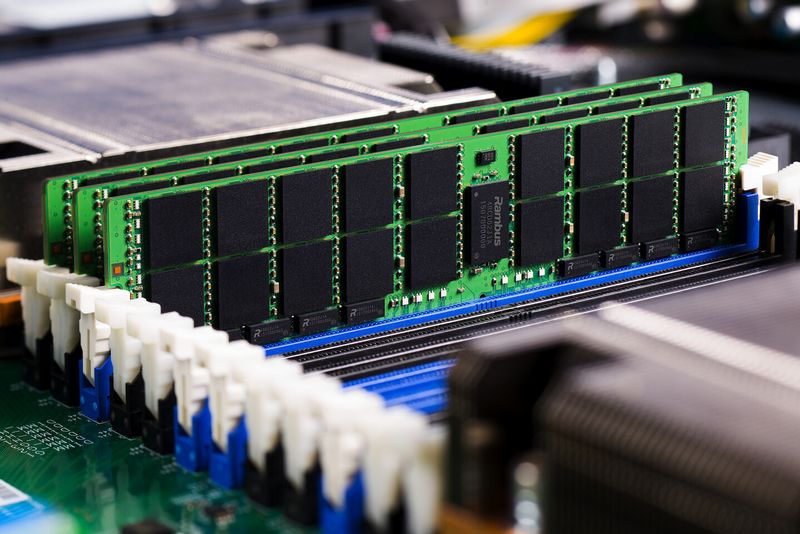

According to analysts familiar with the semiconductor industry, the memory sector will suffer drastic consequences following the memory chip price cuts. Major memory chip manufacturers such as Samsung, SK Hynix and Micron will have to sell their products more expensively before prices drop enough to make them profitable again.

Samsung is announcing plans to cut production, reduce shipments and raise prices on memory to address the current lack of sales. SK Hynix and Micron have also reported production cuts in recent quarters, and Samsung has now joined them.

The price decline of NAND flash memory chips is expected to slow due to supply cuts by major manufacturers such as Micron and Kioxia, and market demand is expected to bottom out in the first quarter of 2023.

Sources close to the memory market say Samsung’s semiconductor sales will lose nearly $1 billion in the first quarter and are expected to double in the next quarter due to this boomerang effect. If the company does not take these drastic measures to fix NAND memory prices, it could have fatal consequences for the company.

TrendForce reported an estimated ten to fifteen percent loss for NAND flash memory in the first quarter of this year, with solid-state drive pricing also expected to suffer.

Sanjay Mehrotra, CEO and chairman of Micron, met with President Biden earlier this year to discuss the semiconductor chip shortage. In the talks, Mehrotra discussed the possibility of relying on partnerships with the private sector to help the U.S. better position itself in today’s chip market. He also talked about the company investing $150 billion over the next decade in research and development and manufacturing of memory, including flash memory.

The private sector partnership Sanjay talked about would also have an impact on China and other Asian countries, which have experienced some obstacles due to global and geopolitical conflicts. Unfortunately, it is not known when the affected markets will recover, which could mean riskier trade practices to offset the losses experienced in general….