Recently, Intel CEO Bob Swan attended Credit Suisse’s annual technical conference and shared many of his unknown ideas about Intel. He acknowledged for the first time to be honest when he said that Intel would no longer insist on pursuing the CPU market share in the future because it would not be conducive to the healthy development of the company; rather, he hoped Intel would become a company that exceeds the CPU.

Bob Swan thinks that concentrating on 90% of the CPU market share is one reason he is missing the transformation opportunities. Several years ago, Intel accounted for more than 90% of the x86 CPU market and its annual revenue in 2017 was $59.4 billion – in contrast, the total revenue of the United States CPU market in 2016 was $66 billion. Now Bob Swan is trying to “destroy” this idea that Intel wants to have 90% of the CPU market. This means that Intel not only has more room for improvement but also diversity.

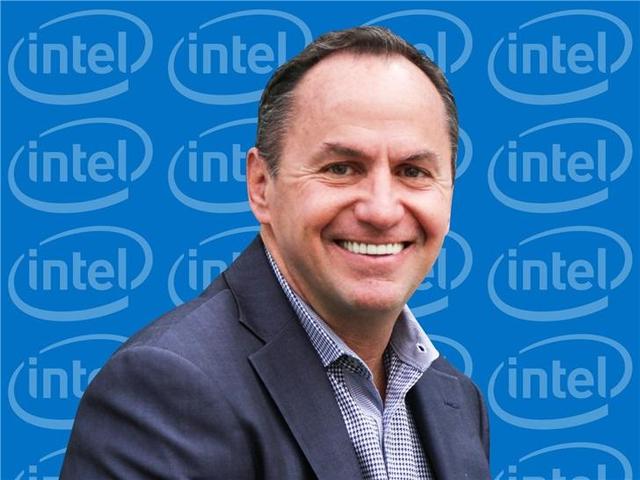

Intel CEO rethinks transition difficulties and wants to “destroy” CPU market share

Recently, Intel CEO Bob Swan attended Credit Suisse’s annual technical conference and shared many of his unknown ideas about Intel. He acknowledged for the first time, to be honest when he said that Intel would no longer insist on pursuing the CPU market share in the future because it would not be conducive to the healthy development of the company; rather, he hoped Intel would become a company that exceeds the CPU.

Bob Swan thinks that concentrating on 90% of the CPU market share is one reason he is missing the transformation opportunities. Several years ago, Intel accounted for more than 90% of the x86 CPU market and its annual revenue in 2017 was $59.4 billion – in contrast, the total revenue of the United States CPU market in 2016 was $66 billion. Now Bob Swan is trying to “destroy” this idea that Intel wants to have 90% of the CPU market. Instead, Bob Swan hopes that Intel will take 30% of the market for “all-silicon”. This means that Intel not only has more room for improvement but also diversity.

Following Bob Swan talks about the above ideas:

Frankly, I’m trying to destroy the idea that “our company wants to keep 90% of the CPU market share,” and I think it restricts our thinking and lets us miss the technology change and many opportunities. At some point, we should look at the broader market with an innovative view, rather than holding on to that 90% CPU market share.

We look forward to playing an increasingly important role in the coming years, not only in the CPU market but also in the GPU, AI, and FPGA markets. Combining these technologies will enable us to solve more problems for our customers. In the development of Nervana processors and Xe GPUs, it is not difficult to see that Intel is ready to gain market share in new markets.

Contrary to Intel’s desire to reduce CPU market share, AMD CEO Lisa Su has tried to abandon the high-end GPU market and deepen the CPU market. Despite Intel’s impressive CPU performance, it still encountered a number of difficulties. Bob Swan says:

First, market demand for CPUs has grown much faster than we expected, especially in 2018 – when we expected demand to grow by 10%, demand turned out to grow by 21%. Second, we also have a large market share in the smartphone modem market.We decided to produce smartphone demodulators in-house, which in turn distracted our CPU manufacturing efforts. To make matters worse, we did not start the 10nm process on time. When this happens, we can only add more power to the previous generation (14nm process); this means we need higher core numbers and more large mold sizes. If specifically what went wrong, I think Intel is too confident that it will be able to outperform industry standards, and we can understand it as the “scar tissue” rule. In fact, Scar Tissue began with Moore’s Law, a simple rule that is multiplied by a scaling factor every two years.

We have decided that, despite the increased physical challenges we face, we will maintain performance at the highest level. Therefore, what we consider a 5nm process is actually what our competitors call 3nm. In the process of the active challenge of 10nm, we have introduced 14+, 14 ++, etc., which also allows us to continuously improve and improve ourselves. We now expect to launch the first 7nm products (equivalent to TSMC’s 5nm process) in the fourth quarter of 2021 and the 20nm products (equivalent to TSMC’s 3nm process) in February 2024.